Retirement & Investment Services

Members Financial ServicesThe MEMBERS Financial Service Program is a personal financial management service designed exclusively of credit union members. This program offers a variety of insurance and investment programs that complement the savings programs offered by Tyndall Federal Credit Union.

To learn about the background of your financial professional, please go to BrokerCheck by FINRA,

Investor Connection

No matter where you are in life or what your goals are, we can help. To get started, contact LPL Financial through our Online Brokerage Center to learn more about financial strategies for long-term financial planning for the items below.

Professional Services:

- Comprehensive Financial Guidance

- Education Funding

- General Investment Management

- Investment Management for Seniors

- Retirement Account Planning

- Insurance Planning

- IRA and 401k Rollovers**

- Long Term Care Insurance

- Retirement Income Planning

- Retirement Planning

- Wealth Management

Please be aware that when you click on the MEMBERS Financial Services or Investor Connection links, you will leave Tyndall Federal Credit Union's website.

Please note:

- You are linking to an alternate website not operated by the credit union;

- The credit union is not responsible for the content of the alternate website;

- The credit union does not represent either the third party or the member if the two enter into a transaction; and

- Privacy and security policies may differ from those practiced by the credit union.

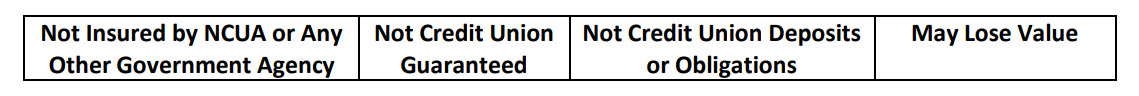

Securities and advisory services are offered through LPL Financial (LPL), a registered broker-dealer (member FINRA SIPC). Insurance products are offered through LPL or its licensed affiliates. Tyndall Federal Credit Union is not registered as broker-dealer or investment advisor. Registered representatives of LPL offer products and services using, and may also be employees of Tyndall Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Tyndall Federal Credit Union. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

To learn more about the background of your financial professional, please go to BrokerCheck by FINRA.

**Prior to requesting a rollover from your employer-sponsored retirement account to an Individual Retirement Account (IRA), you should consider whether the rollover is suitable for you. There may be important differences in features, costs, services, withdrawal options, and other important aspects between your employer-sponsored retirement account and an IRA.

FR-2203235.1-0818-0920